Gold Price Forecast: Bulls Target $3,429 as CPI Cools and Fed Rate Cut Bets Rise

Gold prices (XAUUSD) are on the move again, hitting a fresh one-week high of $3,377. With weaker-than-expected U.S. inflation data, renewed trade tensions, and rising geopolitical instability, the yellow metal is catching fire. Traders are now eyeing a breakout toward $3,429, driven by a powerful combination of macro and technical catalysts.

In this article, we’ll break down the latest gold market drivers, the technical setup, and what to watch next. Whether you’re trading gold manually or using VIP signals from GoldSniperVIP.com, this is a critical time to stay ahead of the trend.

May’s Consumer Price Index (CPI) report came in below expectations, with headline inflation rising 2.4% year-over-year, slightly under the 2.5% forecast. Core CPI held steady at 2.8%, reinforcing hopes that the Federal Reserve may cut rates as early as September.

The result? U.S. Treasury yields dropped, the dollar sank to a one-month low, and gold—being a non-yielding safe-haven asset—became even more attractive.

According to the CME FedWatch Tool, there is now a 70% probability of a rate cut by September, further fueling bullish sentiment.

✅ Pro Tip: Want to trade gold with professional guidance? Join the free Telegram channel or go VIP at GoldSniperVIP.com for high-probability trading signals.

Risk-off sentiment surged as tensions flared on the global stage:

The U.S. authorized voluntary evacuation of military families from the Middle East.

Russia intensified drone strikes on Ukraine, particularly targeting Kharkiv.

Iran issued retaliatory warnings, increasing fears of escalation.

With rising uncertainty, investors are flocking to gold as a safe-haven hedge, adding momentum to the ongoing rally.

Gold remains fundamentally supported by a perfect storm of macroeconomic factors:

Geopolitical tensions – US-China trade conflict and Russia-Ukraine conflict escalate risk-off sentiment.

US fiscal uncertainty – Mounting debt and deficit concerns fuel the “sell America” narrative.

Fed rate cut expectations – Markets are now pricing in at least two rate cuts in 2025, making gold more attractive as a non-yielding safe haven.

Key Fed Statements:

Fed Governor Waller: Rate cuts still possible this year.

Chicago Fed’s Goolsbee: Rates can come down in 12–18 months.

Dallas Fed’s Logan: Policy patience is warranted, watch for inflation risk.

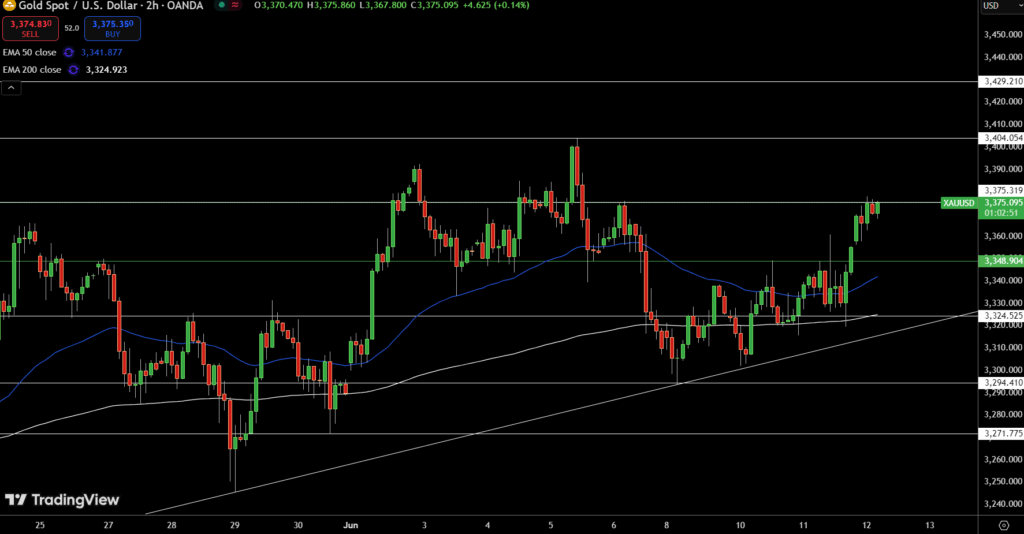

Gold has now broken out of a bullish ascending triangle pattern, signaling a continuation move to the upside.

🔍 Key Technical Levels to Watch:

Resistance:

$3,375 (current breakout level)

$3,404 (first major target)

$3,429 (next upside extension)

Support:

$3,348 (recent breakout base)

$3,325 (EMA confluence zone)

The price is trading well above the 50 EMA ($3,341) and 200 EMA ($3,324), confirming a strong technical structure with higher lows and bullish momentum.

Upcoming Events to Watch

Keep your eyes on this week’s U.S. Producer Price Index (PPI) and jobless claims data. A further softening in economic indicators could push the Fed closer to a rate cut—sending gold toward $3,429 and beyond.

📚 For a deeper understanding of how to trade these setups, visit YourTradingJourney.com—your go-to resource for mastering technical analysis and improving your trading strategy.

Conclusion: Gold's Path of Least Resistance Is Up With

With inflation cooling, Fed policy shifting, and global tensions rising, gold is in a strong position to extend its gains. As long as price holds above key support zones, the bullish bias remains intact.

If you’re serious about maximizing your profits in this environment, now is the time to act. The Gold Sniper VIP Channel offers high-conviction entries based on real market structure and live setups.

👉 Join now and trade gold like a sniper at GoldSniperVIP.com.

With inflation cooling, Fed policy shifting, and global tensions rising, gold is in a strong position to extend its gains. As long as price holds above key support zones, the bullish bias remains intact.

If you’re serious about maximizing your profits in this environment, now is the time to act. The Gold Sniper VIP Channel offers high-conviction entries based on real market structure and live setups.

👉 Join now and trade gold like a sniper at GoldSniperVIP.com.

Fed Watch Countdown

Time until next FOMC meeting:

✅ Want to Trade Gold Like a Pro?

Take the guesswork out of the markets.

Join thousands of traders who trust GoldSniperVIP.com for real-time XAU/USD trading signals based on proven strategies and precision technical analysis. Whether you’re a scalper, swing trader, or prop firm trader — our gold signals are built to help you pass challenges and grow your capital.

🚀 Tap into consistent profits. Get the sniper edge.

👉 Join GoldSniperVIP.com now — the #1 Telegram channel for gold signals.