Gold Price Forecast: XAU/USD Soars as Israel-Iran Conflict Triggers Safe-Haven Surge

The price of gold (XAU/USD) is rallying over 1.5% during the Asian trading session on Friday as escalating tensions between Israel and Iran fuel intense safe-haven demand.

This geopolitical shock has reignited gold’s bullish momentum, pushing it to seven-week highs and setting the stage for a potential run toward $3,500.

Gold’s surge was sparked after reports confirmed that Israel launched strikes on Iranian nuclear facilities, aiming to halt Tehran’s alleged efforts to develop atomic weapons. In swift response, Iranian media outlets claimed that a formal declaration of war against Israel is imminent.

On Friday, Iran’s Armed Forces General Staff issued a strong warning, declaring that Israel and the U.S. will “pay a very heavy price” for their actions. In response to rising tensions, former U.S. President Donald Trump has called an emergency National Security Council meeting at 15:00 GMT.

Whenever markets are gripped by uncertainty, investors seek shelter in traditional safe-haven assets — and this time is no different. Gold, U.S. Treasury bonds, and the Japanese Yen (JPY) are seeing strong inflows.

Gold is now on a three-day winning streak, breaking through critical technical levels and heading toward major resistance. With geopolitical risk surging, bulls are eyeing $3,500 as the next big milestone — especially if Iran retaliates militarily.

While gold benefits from risk-off flows, it’s not alone — the U.S. Dollar (USD) is also being bid up as a global safe haven. A stronger dollar could slow gold’s upside momentum in the short term, creating friction near key resistance zones.

Despite this, gold’s strong technical breakout suggests the path of least resistance remains higher — at least for now.

Amid this geopolitical storm, markets have largely ignored economic news. Reuters recently reported that new tariffs on steel derivative products and imported household appliances will take effect on June 23, but the impact has been muted.

Even important data like the University of Michigan’s Consumer Sentiment Index and Inflation Expectations will likely take a backseat as traders remain laser-focused on developments in the Middle East.

In parallel, soft U.S. CPI and PPI figures earlier this week have increased expectations of a Federal Reserve rate cut in September, adding an extra tailwind for gold prices.

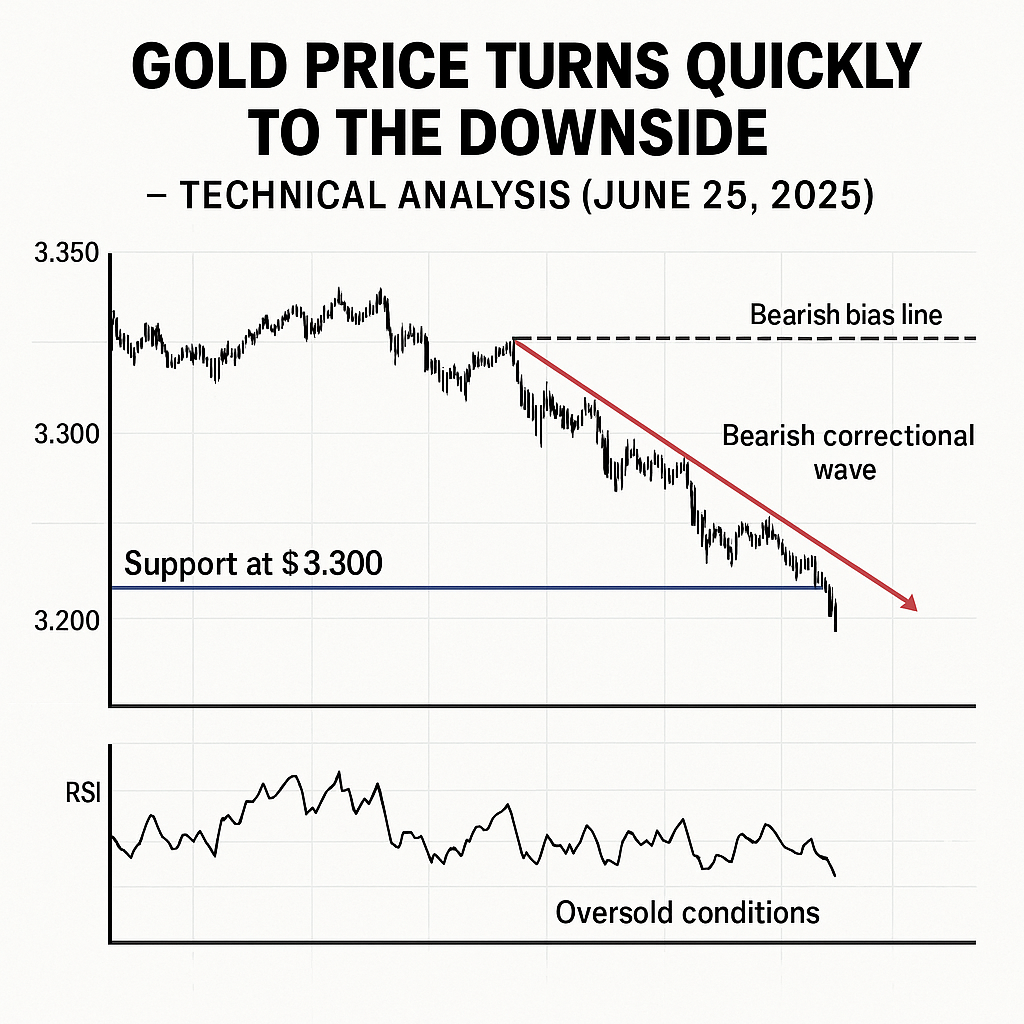

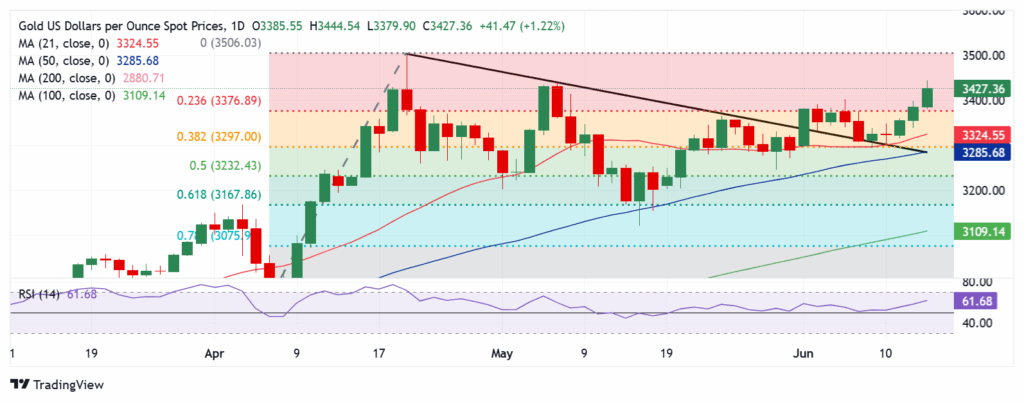

Technical Outlook: Gold Price Daily Chart

From a technical standpoint, gold closed Thursday above $3,377, the 23.6% Fibonacci retracement level from April’s historic rally. This breakout confirms a continuation of the bullish trend.

The 14-day RSI remains strong at 62, comfortably above the midline, suggesting room for further upside. If momentum continues, the next key resistance sits at $3,450, followed by the all-time high of $3,500.

Key Support and Resistance Levels:

Immediate Support: $3,400

Fibonacci Support: $3,377

Major Support (21-day SMA): $3,325

Resistance Zone: $3,450

Major Breakout Target: $3,500

Watch these levels closely, especially as news from Iran or Israel could spark rapid volatility in both directions.

Final Thoughts: Geopolitics Driving the Gold Narrative

With the world’s eyes on the Israel-Iran conflict, gold remains a top choice for investors seeking security. Should Iran retaliate — militarily or otherwise — we could witness a fresh breakout beyond $3,500, possibly marking new all-time highs for XAU/USD.

Fed Watch Countdown

Time until next FOMC meeting:

✅ Want to Trade Gold Like a Pro?

Take the guesswork out of the markets.

Join thousands of traders who trust GoldSniperVIP.com for real-time XAU/USD trading signals based on proven strategies and precision technical analysis. Whether you’re a scalper, swing trader, or prop firm trader — our gold signals are built to help you pass challenges and grow your capital.

🚀 Tap into consistent profits. Get the sniper edge.

👉 Join GoldSniperVIP.com now — the #1 Telegram channel for gold signals.