Bitcoin Price Drops After Trump Escalates Iran War Tensions – BTC and ETH Technical Analysis

Bitcoin Iran war news shook the crypto markets as the price of Bitcoin dropped sharply from $106,000 to $102,000 following renewed geopolitical tensions.

📈 Bitcoin Price Crash Caused by Geopolitical Risk in the Middle East

Rising fears over a potential military escalation between Israel and Iran, intensified by Donald Trump’s remarks, sent shockwaves through global markets. Crypto assets, especially Bitcoin (BTC), were hit hard.

- BTC fell from $106,000 to $102,000 in minutes

- Ethereum (ETH) dropped 6% from $2,500

- Risk-off sentiment pushed down tech stocks and altcoins alike

- The correlation between Bitcoin and global conflict headlines has become increasingly evident in recent months.

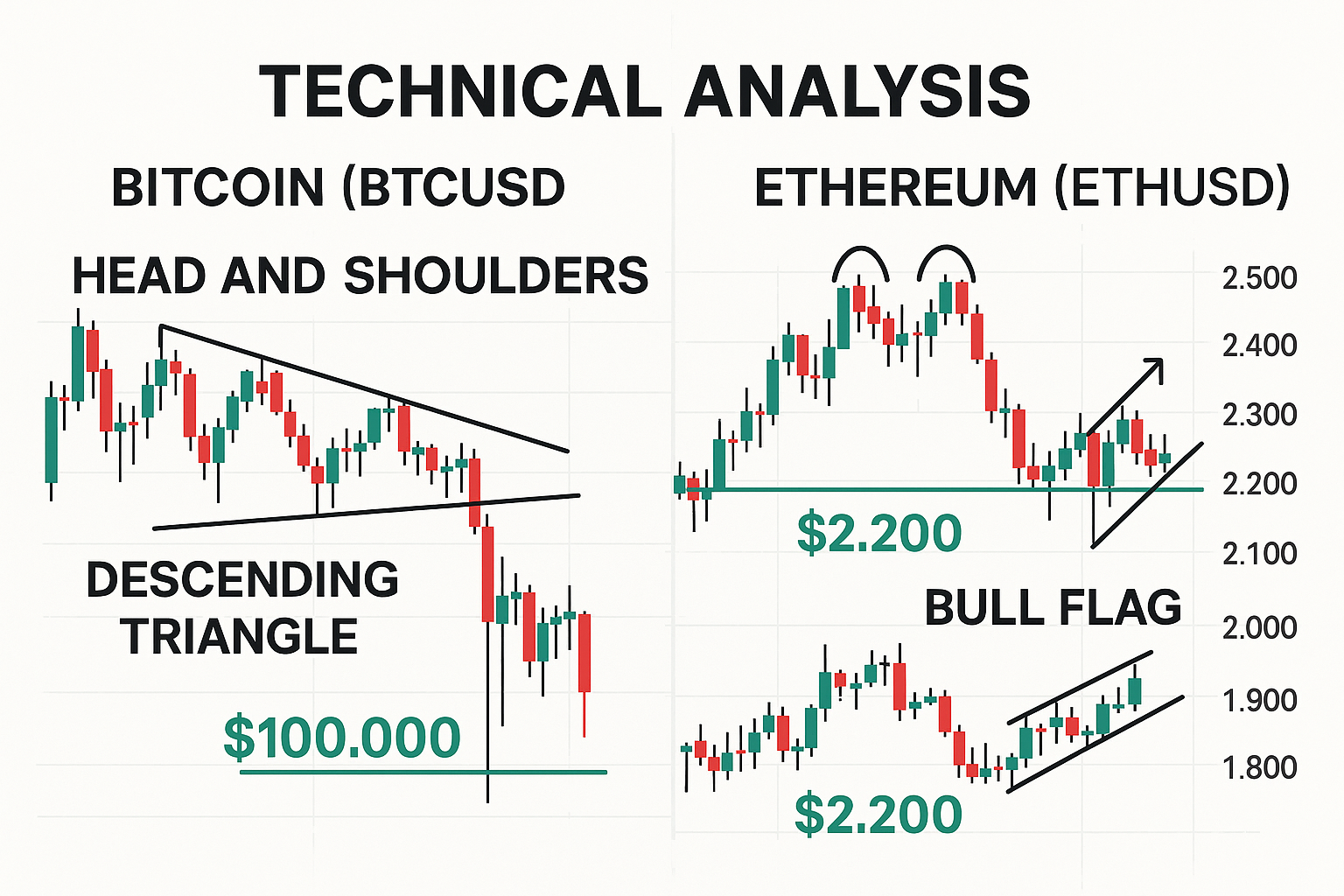

Bitcoin Technical Analysis: Bull Flag or Bearish Breakdown?

On the weekly Bitcoin chart, a classic bull flag pattern remains visible, hinting at a longer-term bullish continuation. However, recent price action on the daily chart raises caution.

⚠️ Daily BTC Chart Showing Head and Shoulders Pattern

A clear head and shoulders structure has formed. If the neckline around $100,000 breaks, the downside target lies at $95,000.

Key levels to watch:

- Resistance: $106,000, $108,000

- Support: $102,000, $100,000, $95,000

- Structure: Descending triangle also building on lower timeframes

🔄 Ethereum Technical Analysis: Support Broken, Bull Flag in Play

Ethereum has also broken short-term support at $2,380, creating downside pressure. Still, the Ethereum daily chart maintains a larger bull flag pattern, suggesting long-term bullish continuation remains intact.

Important ETH levels:

- Resistance: $2,500

- Support: $2,200, $2,100

- Breakdown trigger: A sustained drop below $2,000 could lead to panic selling

🧠 Sentiment Analysis: Market Volatility Driven by Iran Conflict

The crypto market is hypersensitive to war-related news. As observed, Bitcoin dumped from $106K to $102K right after Trump’s Iran comments. Traders with laddered buy orders around $102K and $100K saw automatic fills.

Short-term volatility is expected to remain high. Traders should monitor news from the Middle East while applying tight stop-losses.

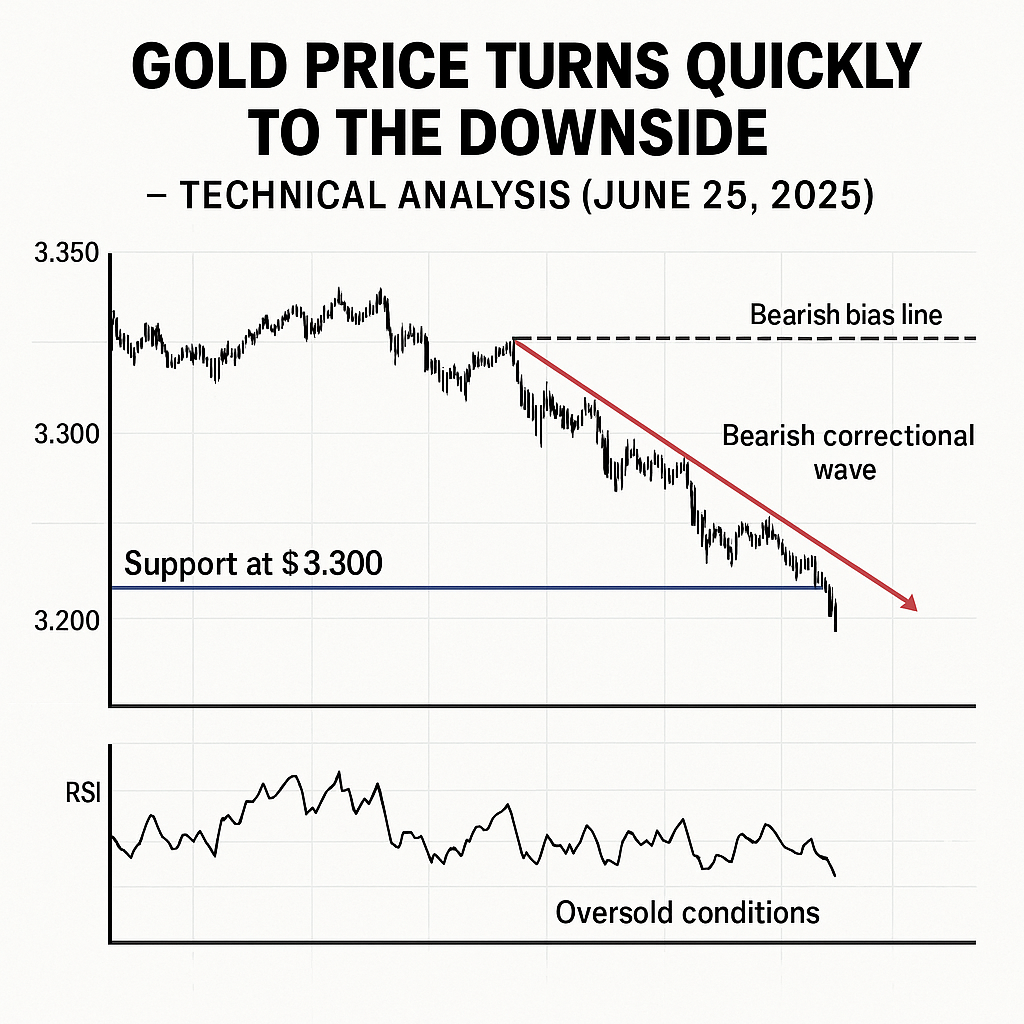

🗓️ Long-Term Outlook: Will the Bitcoin Bull Market Survive the War Headlines?

Many analysts agree the current bull market is still alive. Historical cycles show that Bitcoin typically peaks 560 days after a halving, putting the expected top around September 2025.

As long as support above $95K holds, long-term Bitcoin price forecasts remain optimistic.

✅ Summary: BTC and ETH React to War News – What Comes Next?

- Bitcoin and Ethereum dropped sharply due to escalating Iran conflict

- BTC forms head and shoulders and descending triangle on daily chart

- ETH breaks support but maintains bullish pattern on longer timeframes

- Market remains fragile amid geopolitical uncertainty

- Next key levels: $100K BTC, $2,200 ETH

For more technical insights, check our daily crypto market analysis.