As of May 2025, the cryptocurrency market is experiencing significant shifts, with Bitcoin facing notable resistance levels and a decline in investor interest. This article delves into the current market dynamics, highlighting critical indicators and potential price trajectories.

Gold prices are on the rise, signaling a shift towards traditional safe-haven assets. This trend often correlates with a decrease in risk appetite, potentially impacting cryptocurrencies like Bitcoin.

Bitcoin is currently struggling to surpass key resistance levels, including the weekly and monthly opens. Failure to break through these points may indicate a bearish trend in the near term.

Critical support zones to watch include

$93,700: Recent support level.

$93,300: Yearly open.

$91,800: Previous range bottom and CME gap area.

A breach below these levels could lead to further declines, potentially targeting the mid-$80,000 range.

The stock market’s performance is also influencing Bitcoin’s trajectory. Major indices are showing signs of weakness, with pre-market indicators in the red. This environment may contribute to downward pressure on cryptocurrencies.

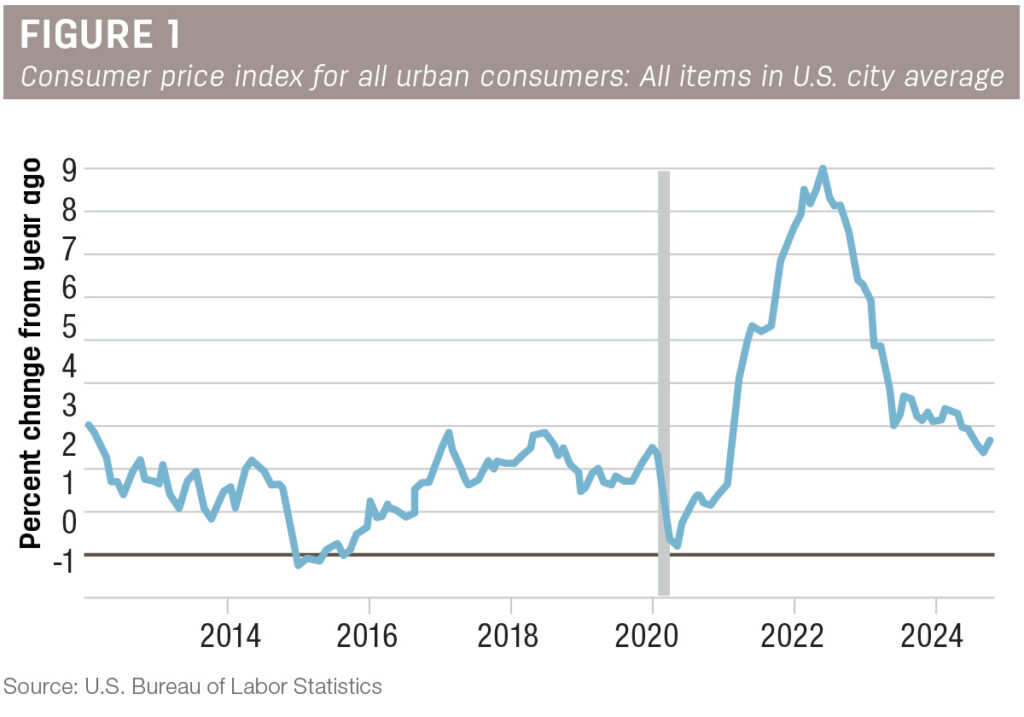

The Federal Reserve’s upcoming meeting is anticipated to maintain current interest rates, with a 98.2% probability of no change. Any unexpected decisions could significantly impact market sentiment.

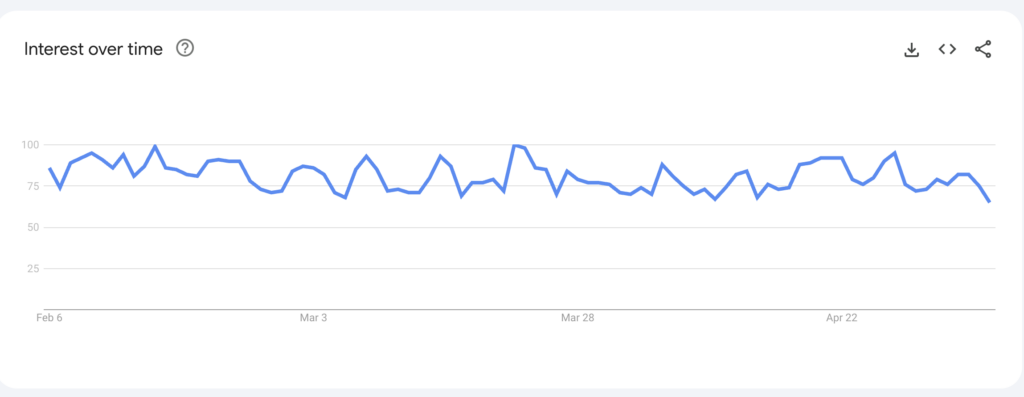

Declining Crypto Interest

Google Trends data indicates a decrease in search interest for cryptocurrencies, reflecting waning public engagement. Social media metrics also show reduced discussions around crypto assets.

The current market conditions suggest a cautious approach to cryptocurrency investments. Monitoring key support and resistance levels, along with macroeconomic indicators, will be crucial in navigating the evolving landscape.