Bitcoin Price Forecast: BTC Braces for Breakdown Amid US-Iran War Fears

Bitcoin Price Forecast: Support at 50-Day EMA in Danger

Bitcoin price forecast shows BTC hanging by a thread as the global market reacts to rising geopolitical tensions. After finding support around the 50-day EMA at $103,100, Bitcoin (BTC) now trades at $104,700, maintaining a fragile bullish posture. However, any decisive close below $103,100 could trigger a deeper correction toward the psychological support at $100,000.

US Prepares Strike on Iran, Bitcoin Traders on Edge

US-Iran Conflict Could Trigger Market Panic

According to Bloomberg, US officials are preparing a military strike on Iran amid the ongoing seven-day war between Israel and Iran. This raises the possibility of a wider conflict that could ignite risk-off sentiment across financial markets.

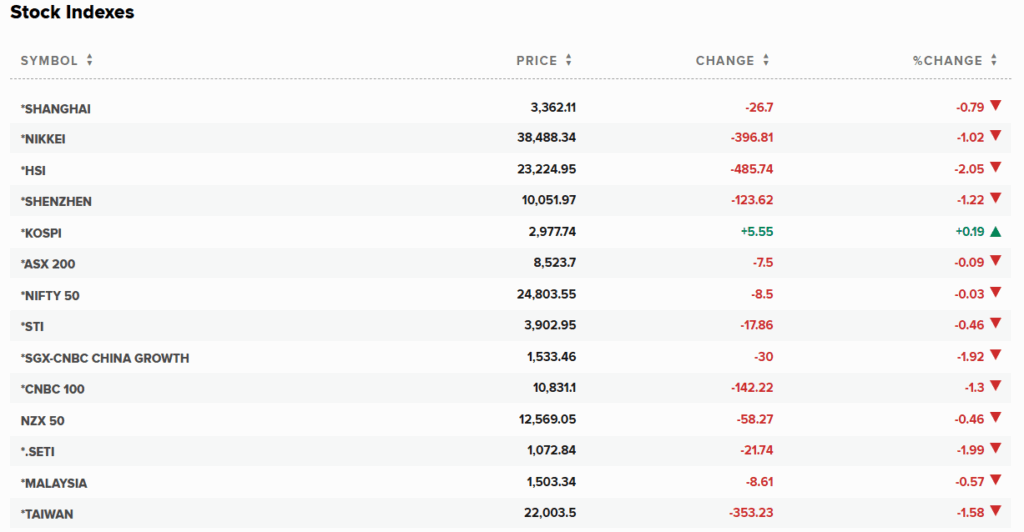

Asian markets reacted negatively to the news (see chart below), yet Bitcoin price remains relatively stable, hovering around $104,700 during the early European session. That said, increased crypto market volatility is expected if a strike materializes.

Institutional Demand Still Strong: US Spot Bitcoin ETFs See Massive Inflows

Despite global uncertainties, institutional investors continue to show confidence in Bitcoin. US spot Bitcoin ETFs saw $389.57 million in inflows on Wednesday—marking eight consecutive days of positive flows since June 9.

This persistent demand could act as a supportive cushion against potential price drops, adding optimism to an otherwise cautious market.

Fed Holds Rates Steady as Geopolitical Tensions Escalate

The Federal Reserve kept interest rates unchanged at 4.25%–4.50%, as expected. Fed Chair Jerome Powell emphasized that any future cuts depend on inflation and labor market data, signaling policy uncertainty ahead.

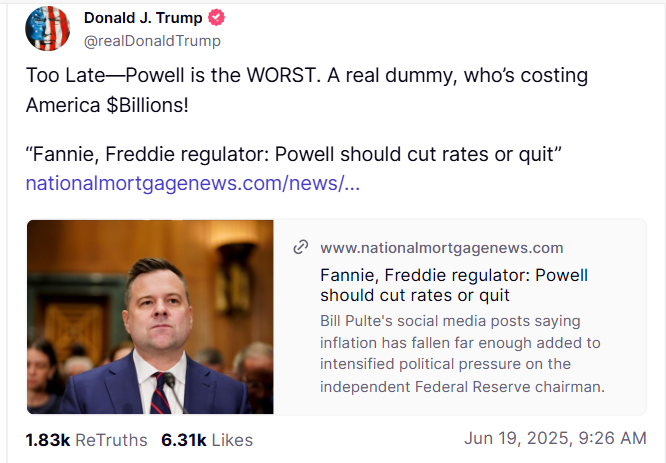

Markets reacted neutrally, but President Donald Trump voiced his disapproval of Powell, calling him a “dummy” who’s “costing America billions.” This political tension may further complicate global market sentiment and affect the Bitcoin price outlook.

Bitcoin Market Outlook: Prepare for Increased Volatility

With a possible US attack on Iran looming, combined with Fed policy uncertainty and Powell-Trump political tension, traders should prepare for heightened Bitcoin volatility.

Still, the continued crypto ETF inflows suggest institutional belief in long-term BTC value remains intact.

Conclusion: Bitcoin Forecast Signals Danger, but Inflows Offer Hope

To sum up this Bitcoin price forecast, BTC is treading on thin ice. A break below the $103,100 50-day EMA could lead to a sharp drop, especially if US-Iran tensions escalate into full-blown conflict.

Yet strong ETF inflows, coupled with the resilient institutional interest, offer a glimmer of stability.