Gold Price Drops to One-Week Low as Fed’s Hawkish Stance Overpowers Middle East Tensions

Gold Price Technical and Fundamental Breakdown: XAU/USD in Focus

The Gold price (XAU/USD) has dropped to its lowest level in over a week, despite rising Middle East tensions and a weaker risk tone. Investors are reacting more strongly to the Federal Reserve’s hawkish outlook, which continues to bolster the US Dollar (USD) and weigh on precious metals.

Why Is Gold Price Falling Today?

Despite multiple bullish factors — including Middle East tensions, USD weakness, and global risk aversion — the gold market remains under pressure. The Fed’s signals for higher-for-longer interest rates are currently overriding demand for safe havens.

Even reports suggesting de-escalation in the Iran-Israel conflict and limited aggression from the US failed to reignite gold bulls. The market seems to be positioning ahead of the weekend and digesting the Fed’s latest policy stance.

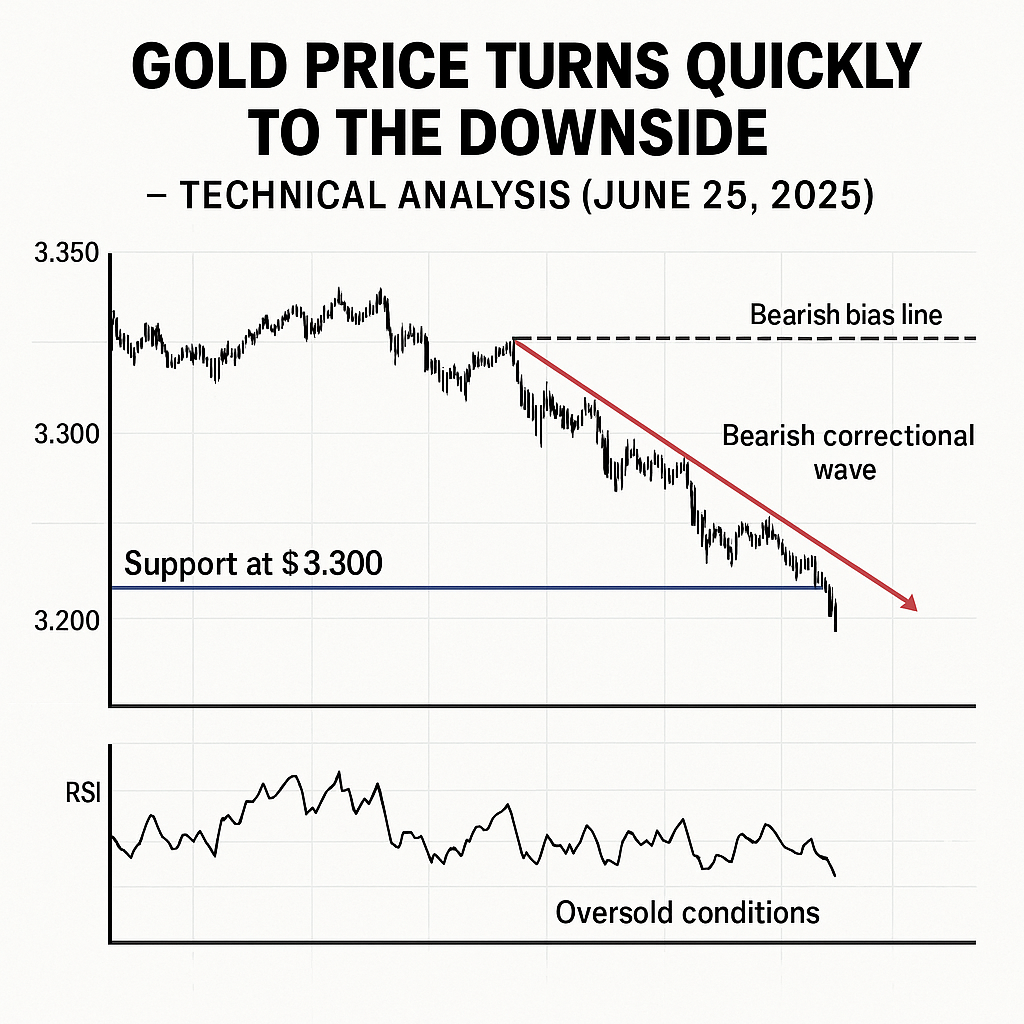

Gold Price Technical Analysis: Will XAU/USD Hold Key Support?

Gold price technical indicators show signs of exhaustion but not complete defeat:

- The 14-day RSI is still above the midline, hovering near 52, suggesting buyers are cautiously optimistic.

- XAU/USD must defend the 21-day SMA at $3,350 to sustain short-term bullish momentum.

- If this level breaks, expect a deeper pullback to:

- 50-day SMA at $3,318

- 38.2% Fibonacci retracement at $3,297

Gold Price Recovery Levels: What Needs to Break?

For the bulls to regain control:

A clear breakout above $3,377 (23.6% Fibonacci level) is needed.

Next upside targets:

- $3,400 psychological level

- Static resistance at $3,440

- Two-month high at $3,455

- Fundamental Overview: Geopolitics vs Fed Policy

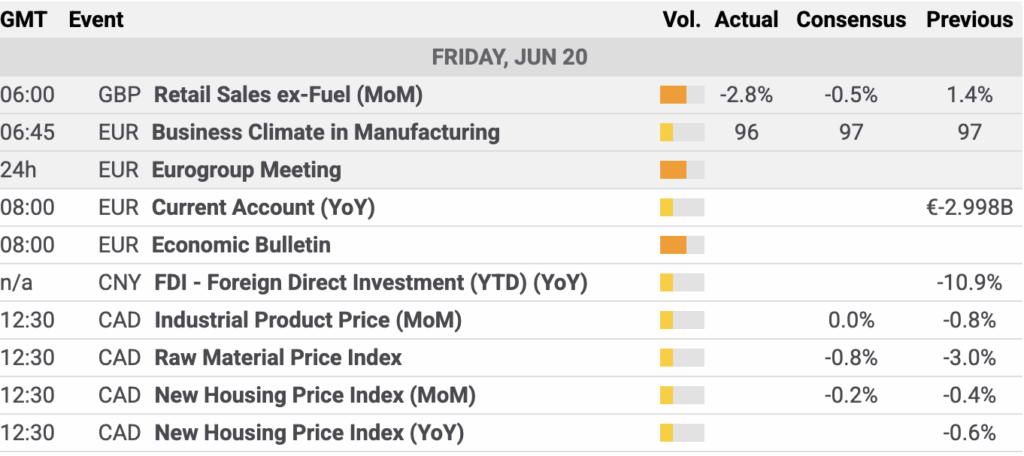

In Friday’s lack of major US economic data, gold price action is dominated by:

- USD fluctuations and overall market sentiment

- Fed’s hawkish policy tone, which supports bond yields and strengthens USD

- Easing fears in the Iran-Israel conflict, after US President Donald Trump reportedly offered Iran a last chance to reach a nuclear deal

Trump’s decision to delay military strikes for two weeks has softened global tension, leading to a rotation out of safe havens like gold.

Will Gold Price Rebound or Continue Lower?

Geopolitical developments remain a wild card. If new tensions emerge over the weekend, gold could reclaim lost ground. However, if markets continue favoring risk assets and the Fed doubles down on its tightening path, XAU/USD may face deeper losses.

Conclusion: Mixed Signals Keep Traders Cautious

The Gold price forecast remains neutral to bearish for now. With the RSI barely holding, and the 21-day SMA at risk, traders should wait for a confirmed breakout or breakdown before taking positions.

Fed Watch Countdown

Time until next FOMC meeting: