Gold Price Prediction 2025: XAU/USD Forecasts and Market Outlook

Gold price bounces off the critical $3,300 level, reflecting a cautious market amid global uncertainties. The XAU/USD price action shows a rebound from the $3,300 neighborhood but faces modest intraday losses heading into Tuesday’s European session. Traders and investors are closely watching ongoing US-China trade talks in London, now extending for a second day, which alongside persistent geopolitical risks, continue to support gold as a safe-haven asset.

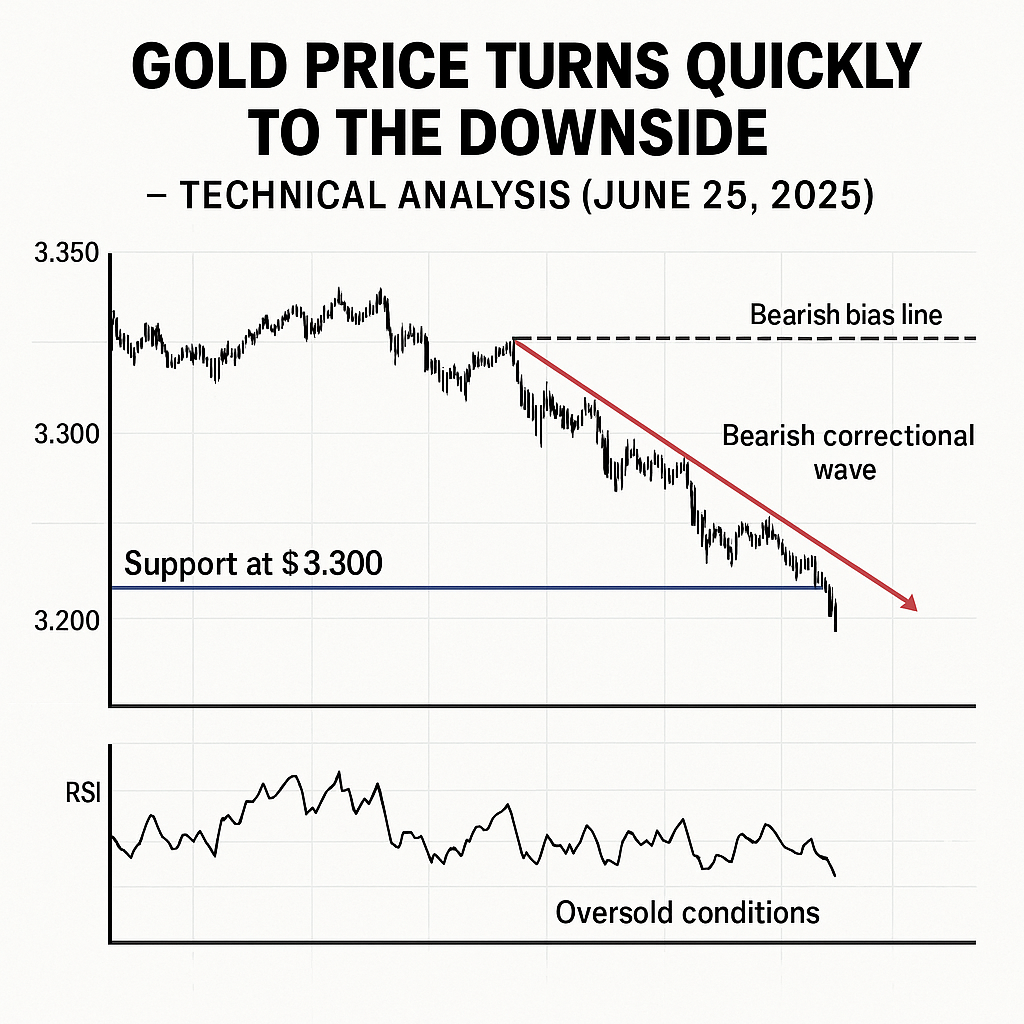

From a technical analysis standpoint, the gold price failed to sustain above the 200-hour Simple Moving Average (SMA), signaling a bearish bias for XAU/USD in the short term. Oscillators on hourly charts are pointing towards further downside, reinforcing the bearish gold price forecast. Should gold break below the $3,294-3,293 support zone, which marks the overnight swing low, we could see the precious metal accelerate declines towards the $3,246-3,245 range (May 29 swing low), potentially testing the psychologically significant $3,200 level.

On the upside, the 100-hour SMA near $3,333-3,334 remains a critical resistance hurdle. A sustained breakout above this zone could trigger a short-covering rally, lifting gold prices towards the $3,352-3,353 level. Further momentum may push the XAU/USD pair to challenge the next resistance at $3,377-3,378. Clearing this barrier would open the path for a fresh attempt to conquer the $3,400 mark, a key psychological level watched closely by traders and analysts alike.

Fundamentally, the gold market outlook for 2025 remains bullish, underpinned by a complex mix of macroeconomic factors. The ongoing US-China trade negotiations and escalating geopolitical tensions continue to act as tailwinds for gold, reinforcing its status as a safe haven. In addition, market expectations for potential Federal Reserve interest rate cuts in 2025 are adding support to the non-yielding yellow metal.

Meanwhile, the US Dollar (USD) is showing signs of weakness, trading near its lowest levels since late April amid growing concerns over the US fiscal outlook. This dollar softness typically benefits gold prices, given the inverse correlation between XAU/USD and the USD index. Traders remain cautious ahead of upcoming US inflation data, which could be a key catalyst for the next significant move in gold prices.

👉 Therefore, any drop below $3,355 could attract buyers.

👉 Support is expected at the $3,326–$3,324 zone.

👉 In contrast, a break below $3,300 may lead to deeper losses toward $3,286–$3,285.

Looking ahead, gold price predictions for 2025 suggest continued volatility driven by geopolitical risks, central bank policies, and inflation trends. Analysts and traders alike are monitoring critical resistance and support levels for XAU/USD, including:

Support levels: $3,200, $3,246, $3,293

Resistance levels: $3,333, $3,377, $3,400

The long-term gold price forecast 2025 hinges on factors such as Fed rate decisions, USD strength, global economic growth, and market sentiment. Investors seeking exposure to precious metals should stay informed on the evolving gold market analysis, paying close attention to technical signals and fundamental drivers.

Fed Watch Countdown

Time until next FOMC meeting:

✅ Want to Trade Gold Like a Pro?

Take the guesswork out of the markets.

Join thousands of traders who trust GoldSniperVIP.com for real-time XAU/USD trading signals based on proven strategies and precision technical analysis. Whether you’re a scalper, swing trader, or prop firm trader — our gold signals are built to help you pass challenges and grow your capital.

🚀 Tap into consistent profits. Get the sniper edge.

👉 Join GoldSniperVIP.com now — the #1 Telegram channel for gold signals.