What Happens to Gold, Crypto, and Stock Markets If World War 3 Starts?v

World War 3: How Markets Will React to a Global Conflict

With rising tensions between global superpowers such as the United States, Russia, China, Iran, and North Korea, the looming possibility of World War 3 has triggered widespread concern. Investors around the world are asking: What happens to the stock market, gold prices, and Bitcoin if nuclear bombs are launched or missile strikes begin? This article breaks down how each major asset class is likely to react and what traders can expect in such a catastrophic event.

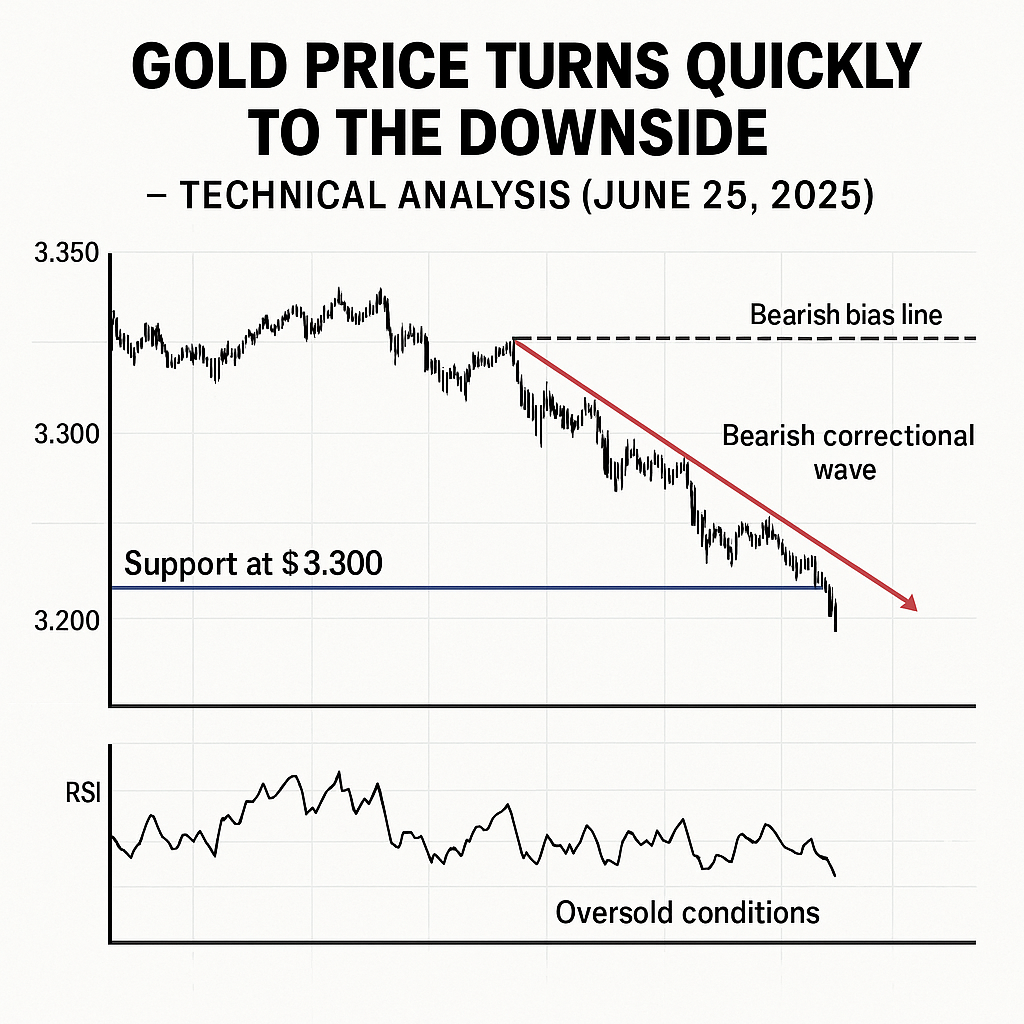

Gold: The Ultimate Safe Haven in Wartime

Whenever geopolitical tensions rise, gold becomes the number one safe-haven asset. In the event of nuclear warfare or international military conflict:

- Gold prices would surge as demand for safe stores of value skyrockets.

- Historical events like the Gulf War, 9/11, and Russia-Ukraine conflict all triggered bullish trends in XAUUSD.

- Central banks in countries like China and India may increase gold reserves.

- If a nuclear missile strike were to occur or if President Biden or Vladimir Putin declared full-scale war, expect gold to quickly jump past resistance levels like $3,400 and aim for targets as high as $4,000.

Keywords: gold price WW3, safe haven gold, buy gold war, gold breakout, gold trend nuclear war, XAUUSD in war, geopolitical tensions gold

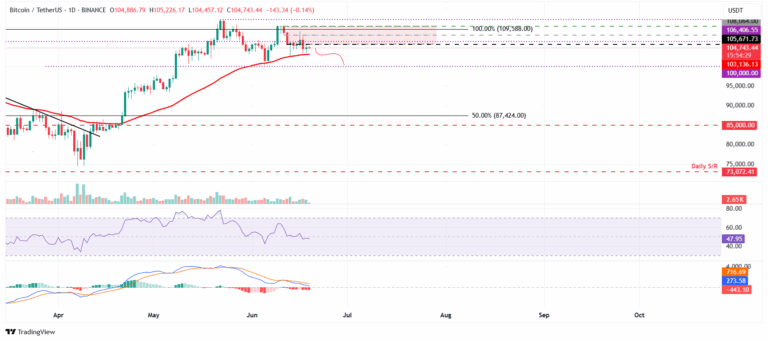

Cryptocurrencies: Bitcoin in the Age of Nuclear Threats

The behavior of Bitcoin (BTC) and altcoins during World War 3 is more speculative, but here’s what analysts predict:

- In the short term, panic selling may trigger a flash crash in BTC price.

- If traditional finance systems fail or get disrupted by cyber attacks, crypto may become the preferred means of cross-border payments.

- A war involving Iran, Israel, or China could lead to the devaluation of national currencies, pushing interest into Bitcoin as digital gold.

However, if internet infrastructure is damaged or global sanctions block crypto exchanges, the market could face huge volatility.

Stock Market: A Global Sell-Off Followed by Sector Rotation

Global equity markets would likely plummet in the early days of a world war. The S&P 500, Dow Jones, and European indices would face massive sell-offs:

- Defense stocks like Lockheed Martin and Raytheon could soar.

- Tech stocks might crash due to supply chain disruptions and semiconductor shortages.

- Safe-haven sectors such as utilities and healthcare would outperform.

If President Xi Jinping of China and President Putin form military alliances while NATO forces mobilize, the market shock could mirror or exceed the COVID-19 crash.

Keywords: stock market WW3, stock crash nuclear war, war stocks 2025, defense stocks surge, WW3 investing, global equities crisis, S&P war reaction

What Happens If Nuclear Bombs Are Used?

If nuclear weapons are launched by states like North Korea or Russia, the financial consequences could be unprecedented:

Global banking systems could fail.

Commodities like oil, gas, and gold would explode in price.

Crypto adoption might spike if fiat becomes unstable.

Keyword cluster: nuclear bomb market crash, missile strike impact on gold, WW3 Bitcoin crash, radiation effect on economy, nuclear threat markets

Final Thoughts: How to Prepare as a Trader

Diversify your assets — include gold, crypto, and defensive stocks.

Use tight risk management and prepare for extreme volatility.

Stay informed with daily updates from trusted sources.

Follow yourtradingjourney.com for breaking news, technical analysis, and insider strategies during global market turbulence.

We cover all the critical geopolitical events, central bank policies, and real-time trading setups that can help you stay ahead in a chaotic world. Subscribe to our newsletter and visit yourtradingjourney.com daily for expert insights.