Price action refers to the movement of a security’s price over time, typically visualized on a candlestick chart. It’s one of the purest forms of technical analysis—free from lagging indicators, messy overlays, or unnecessary clutter. Traders use price action to make real-time decisions based on how price behaves at key levels.

Price action is all about reading the story the chart tells you, using nothing but the price itself.

Reading price action starts with understanding how price reacts at support and resistance levels, trendlines, and key psychological zones. When price bounces from a level multiple times, it builds confluence. You don’t guess the market—you observe how it reacts.

Ask yourself:

Is price respecting a level?

Are buyers or sellers in control?

Is the market trending or ranging?

Price action is all about reading the story the chart tells you, using nothing but the price itself.

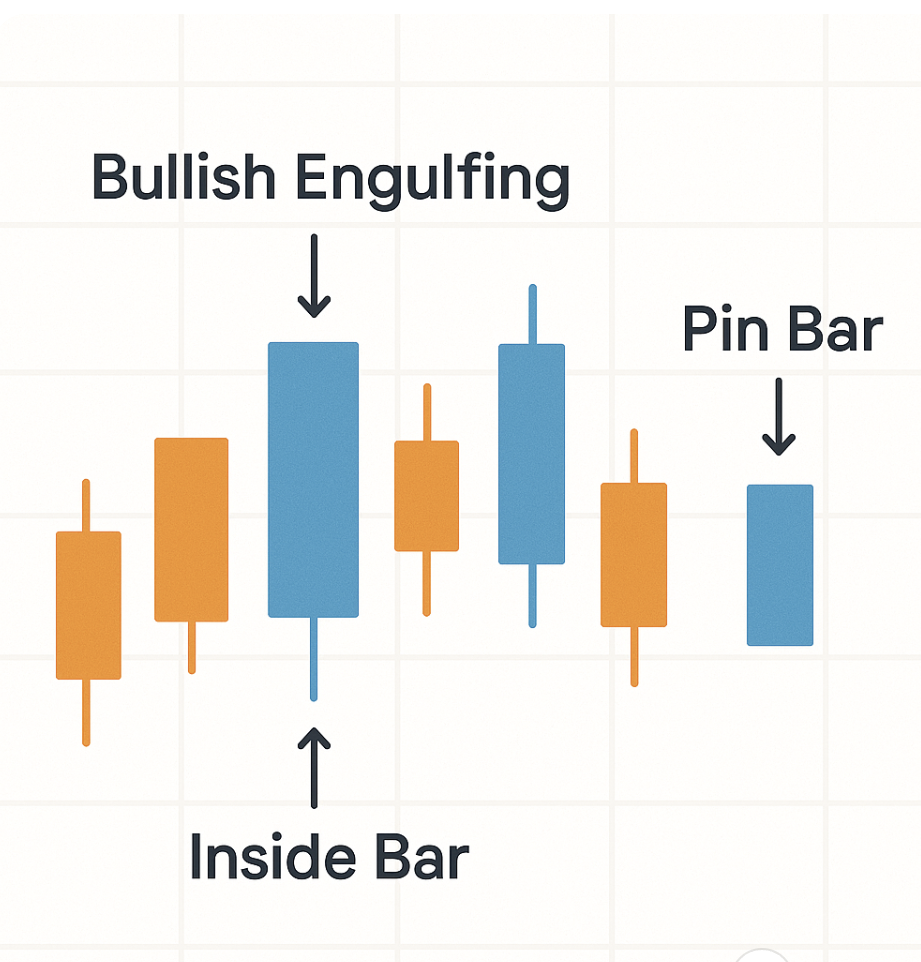

Candlestick formations are your clues. Common patterns like bullish engulfing, pin bars, doji, or inside bars tell you if momentum is shifting. A bullish engulfing after a downtrend signals buyer strength. A bearish pin bar at resistance? Time to watch for a drop.

Mastering candlesticks is like learning to read a new language—the language of smart money.

Ask yourself:

Is price respecting a level?

Are buyers or sellers in control?

Is the market trending or ranging?

Price action is all about reading the story the chart tells you, using nothing but the price itself.

Price action traders love market structure—it shows the rhythm of higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. When structure breaks, it’s a potential shift in trend. Recognizing market structure breaks is vital for sniper entries.

This helps you stay on the right side of the trend and avoid early entries or chasing price.

Once you understand how price reacts and forms patterns, you can build price action trading strategies:

Identify key zones (support/resistance)

Wait for candlestick confirmation (e.g., engulfing)

Watch market structure (trend or reversal)

Enter with confluence, not guesswork

Whether you’re scalping, day trading, or swing trading—price action works on every timeframe.

Indicators lag. News is noise. But price? Price tells you everything. When you learn to understand price action, you gain the skill to read any chart in any market—forex, crypto, gold, stocks.

Price action is not a signal, it’s a skill. And the more you practice, the sharper you get.